Governments today face growing fiscal pressures amid global uncertainty. In this context, carbon pricing and markets offer a triple win: they mobilize finance, drive innovation, and deliver both climate and development goals.

For over two decades, the State and Trends of Carbon Pricing report provides a global pulse check—grounded in data, evidence, and practical insights.

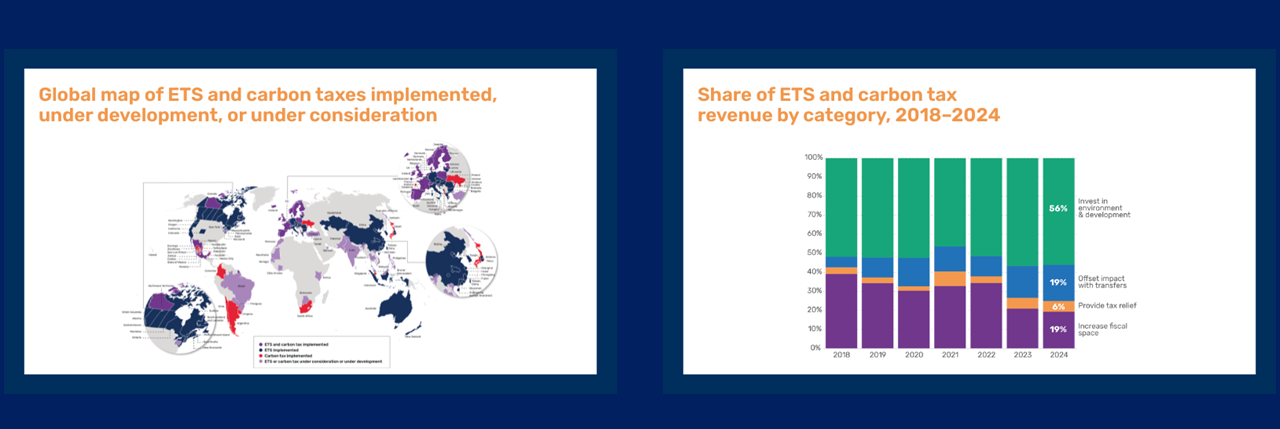

Today, 28% of global emissions are covered by direct carbon pricing, and countries representing two-thirds of global GDP now use either a carbon tax or an emissions trading system.

Here are some key highlights emerging from this year’s report:

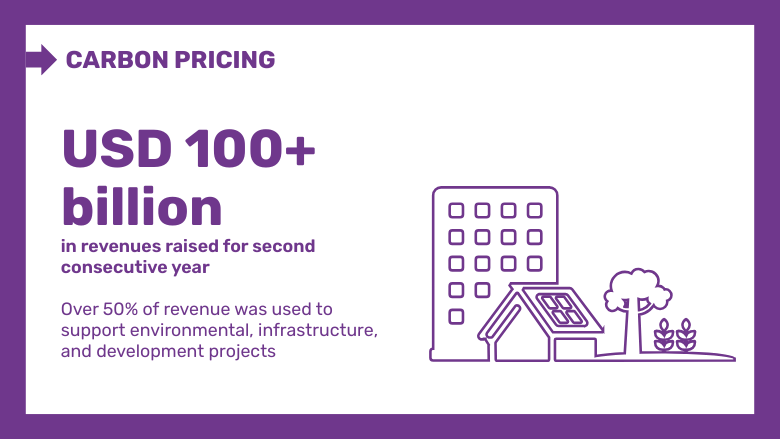

1. We are seeing encouraging momentum: in 2024 carbon pricing raised over 100 billion dollars in revenue for the second consecutive year. This is a strong signal of the potential to raise revenue and deliver on broader sustainability and development goals

2. Emerging economies are stepping in: countries like Brazil, India, and Türkiye are moving forward with national carbon pricing instruments. Others, such as Zambia, Tanzania, Paraguay, and Viet Nam, are laying the groundwork to participate in international carbon markets.

Carbon markets are also gaining traction. They are not just climate tools—they are development tools. By channeling investment into climate-smart technologies and nature-based solutions like forests, carbon credit markets are helping to deliver multiple dividends: cleaner air, better energy access, more resilient livelihoods, and healthier ecosystems.

We also see real innovation on the ground. India is pioneering a rate-based emissions trading system. And new insurance products—including a political risk guarantee by The World Bank ’s Multilateral Investment Guarantee Agency ( MIGA )—are de-risking investments in international carbon markets.

3. The private sector has a vital role to play – as an investor, innovator, and active participant in both compliance and voluntary markets. More companies are operating under compliance obligations and engaging in voluntary carbon markets—helping to mobilize finance for climate action in developing countries. But this also raises the stakes: we need credible, efficient, and interoperable infrastructure to ensure trust and transparency across markets.

4. Countries need to put in place the right regulatory environment. Standardized and simplified regulations, guidelines, and registries are essential to attracting investment and putting in place the right infrastructure.

These trends are encouraging - but not enough. Current price levels and coverage of carbon pricing are insufficient. We need stronger political will, stronger global frameworks, and more international cooperation.

This blog was originally published on the ‘Knowledge Bank Onwards’ LinkedIn page.